Optimal Time to Invest: Bremerton-Silverdale Real Estate Insights

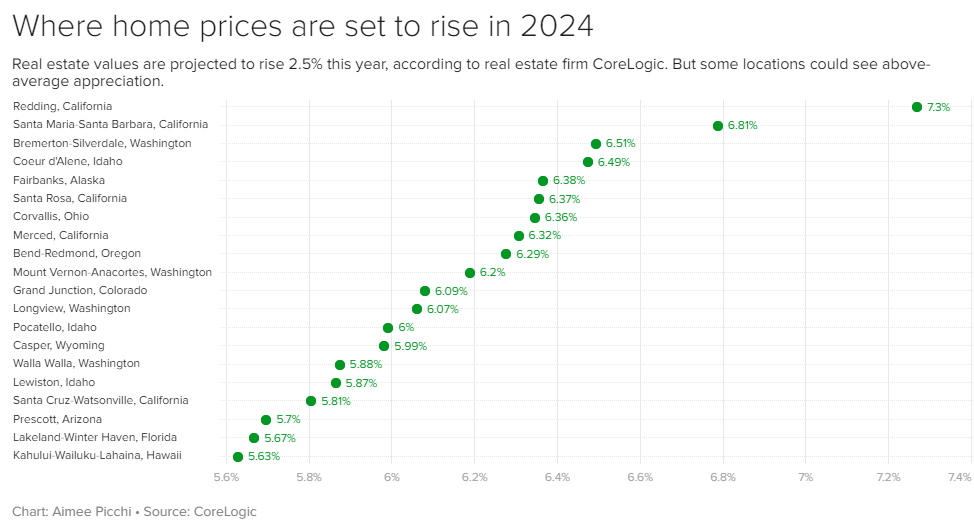

The real estate market is an ever-changing landscape, influenced by various factors such as economic trends, population growth, and local development. As we step into 2024, an exciting opportunity presents itself in the Bremerton-Silverdale area, with forecasted appreciation gains that could significantly benefit prospective investors and buyers. In this blog, we'll dive into the reasons why taking action now might be the key to unlocking substantial returns, drawing insights from a chart provided by Aimee Picchi from CBS News' Money Watch article released January 16, 2024 with data sourced by CoreLogic.

Projected Appreciation Gains:

Aimee Picchi's chart, supported by CoreLogic data, points to substantial appreciation gains in the Bremerton-Silverdale area for 2024. This forecasted growth suggests that property values are expected to rise, providing early investors with the chance to capitalize on the appreciating market.

Population Growth and Economic Prosperity:

Bremerton-Silverdale has been experiencing steady population growth and economic prosperity in recent years. As more people are drawn to the area, demand for housing is likely to increase, leading to higher property values. Investing now positions you to ride the wave of this upward trajectory, potentially yielding impressive returns as the area continues to flourish.

Limited Housing Inventory:

One key factor influencing property values is the balance between supply and demand. Currently, the Bremerton-Silverdale area is experiencing a limited housing inventory, which can contribute to increased demand for available properties. By entering the market now, you have the advantage of securing valuable real estate before the competition intensifies, potentially driving up prices.

Preserving Buying Power:

Buying now with current interest rates safeguards and preserves your buying power. It ensures that you make a real estate investment in an environment that is conducive to financial growth, rather than potentially compromising your financial position by waiting for elusive rate drops that may or may not materialize. Buying now allows for buyers to secure properties at a potentially more reasonable cost, avoiding the pitfalls of purchasing when values are at their peak.

Local Development Initiatives:

Stay informed about local development initiatives and infrastructure projects in the Bremerton-Silverdale area. Municipal investments and improvements can significantly impact property values. By investing early, you position yourself to benefit from the increased desirability that often accompanies urban development and revitalization efforts.

By overviewing the above, I hope it's helpful to understand why Investing now presents a unique opportunity to capitalize on this projected growth, taking advantage of factors such as population growth, limited housing inventory, favorable buying power, and local development initiatives.

As with any investment, thorough research and consultation with a seasoned real estate and mortgage professional are crucial. However, for those seeking to maximize their returns, the time to act in Bremerton-Silverdale is now. Seize the opportunity, position yourself strategically, and embark on a journey towards potential financial success in the dynamic world of real estate. Looking to get pre-approved for a home loan to by in the Bremerton or Silverdale areas? Send me a message today! nick.jeatran@nafinc.com or call/text 360-801-5870.

Source: CBS Money Watch Article on the 20 cities where home prices could see the biggest gains in 2024 - and where prices could fall.

Share This Article