Down Payment Assistance Programs

There are several ways you may be able to take advantage of these programs to support your home purchase. Schedule a time that works for you, and let's explore your options together to see if you qualify!

Washington State Housing Finance Commission (WSHFC) Programs

List of Services

-

Home Advantage ProgramList Item 2

Supported by the WSHFC, this program allows homebuyers to finance a down payment and closing costs through a deferred second mortgage at a 0% interest rate on a 30-year loan term.

+ No first-time homebuyer requirement

+ Homebuyer(s) must attend a WSHFC-sponsored homebuyer seminar

+ Maximum annual income limit $180,000*

+ FHA, VA, USDA, and Conventional loans available

+ Eligible households in all counties may qualify for a maximum loan amount of up to 3% or 4% of the total loan amount.

+ Alternatively, eligible households can qualify for up to 5% using the Home Advantage Conventional or FHA loan.

-

House Key Opportunity ProgramList Item 3

Supported by the WSHFC, this program offers below market interest rates and is often combined with a second mortgage for down payment assistance.

+ Must have a certificate obtained from a Commission-sponsored homebuyer education seminar within the last two years.

+ First-time homebuyer, defined as someone who has not owned and occupied a primary residence at any time in the past 3 years.

+ Meet the program income and acquisition cost limits.

+ Either purchasing never-occupied, new construction or you qualify for down payment assistance programs.

+ Meet with Nick Jeatran to determine if you qualify for an FHA, VA, Conventional, or USDA mortgage loan.

-

Covenant Homeownership ProgramList Item 1

Leverage up to $150,000 in assistance with this program!

If you have deep roots in Washington state (before 1968), it’s possible that you can leverage the Covenant Homeownership Program when buying a home. The Covenant Homeownership Act has created this program and is the funding source to represent a new commitment to correct this injustice, and other housing discrimination, such as redlining and exclusionary zoning, and to help impacted families begin building wealth through the goal of ownership.

+ This program provides down-payment and closing cost assistance for first-time homebuyers in the form of a loan, secondary to the primary mortgage loan.

+ Strategic homebuying resource course required

+ Income limits apply but no purchase price limits

+ Available High Balance, 30-Year Fixed-Rate Conventional, FHA, USDA, and VA product options

+ The homebuyer or a parent/grandparent/great-grandparent lived in Washington state before April 1968.

+ The person who lived in Washington before April 1968 is Black, Hispanic, Native American, Alaska Native, Native Hawaiian or other Pacific Islander, Korean or Asian Indian.

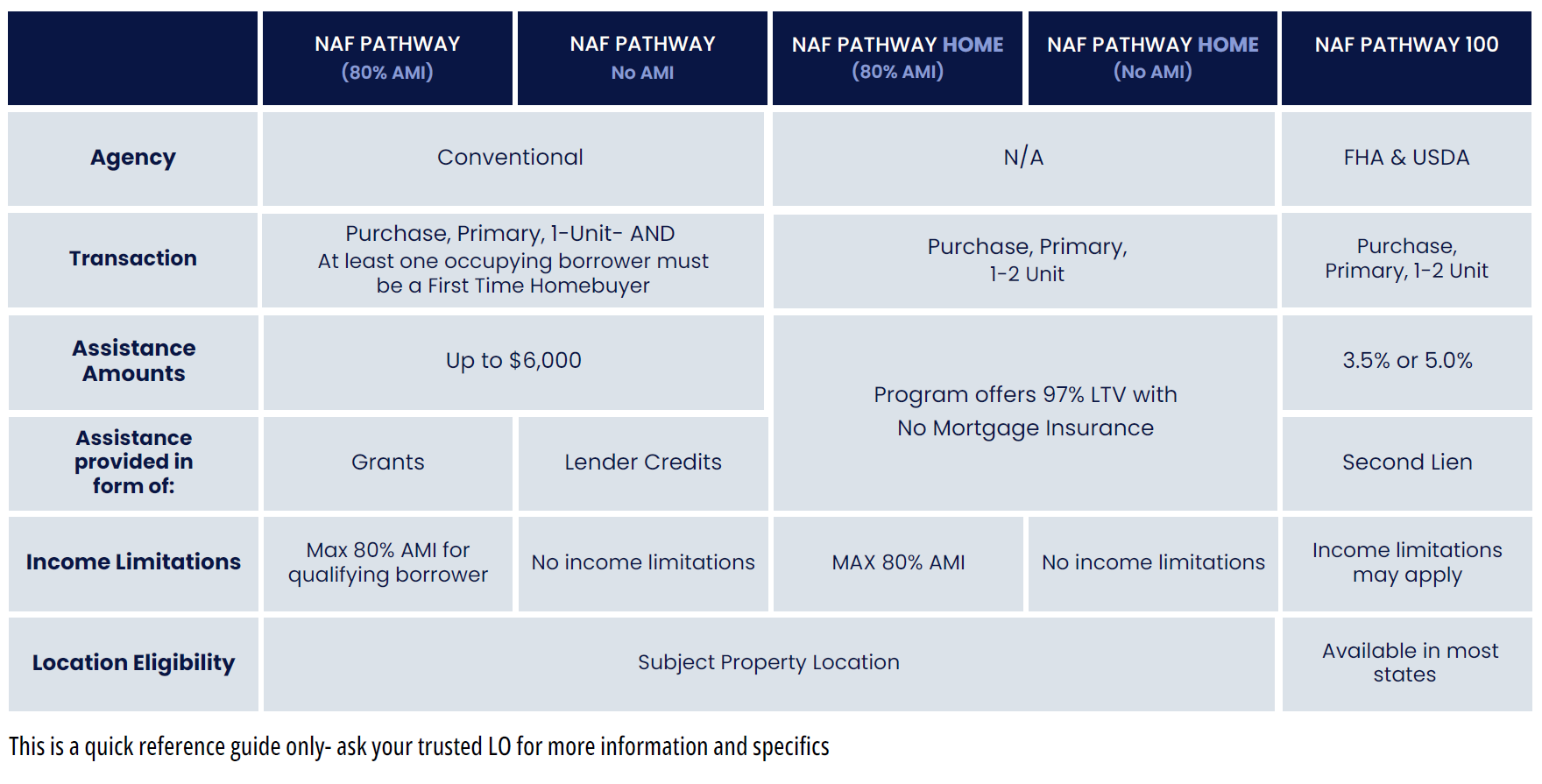

NAF Pathway Down Payment Assistance Programs

Our NAF Pathway program is another valuable resource that offers eligible clients up to $6,000 in assistance toward their down payment and closing costs—and in some cases, it can even be combined with other down payment assistance programs like those offered from the WSHFC! Reach out to learn more about NAF Pathway.

Find Out If You Qualify for Down Payment Assistance!

*Subject to borrower and property qualifications. Not all applicants will qualify. Rates and terms are subject to change without notice. All mortgage loan products are subject to credit and property approval. Credit up to $6,000 maximum. Due to maximum seller concession rules applicable to purchase loan transactions, this credit could be less than $6,000 in some cases where other concessions have been made to the consumer. Credit up to $7,500 maximum. Due to maximum seller concession rules applicable to purchase loan transactions, this credit could be less than $7,500 in some cases where other concessions have been made to the consumer. For more information and full details on Washington State Housing Finance Commission programs visit wshfc.org